HDI Provides Customizable Solutions for Insurance Verification

As the original developer and program administrator for Alabama’s Mandatory Liability Insurance program, HDI Solutions, LLC has been providing clients with insurance verification services since the early 2000s. HDI has extensive experience in insurance data matching—processing millions of inquiries quickly and accurately—and implementing insurance verification programs across the nation. The ability to meet industry standards and employ cutting-edge technologies allows states to seek less obtrusive and more efficient ways to enforce financial responsibility laws.

Whether it’s helping states currently running their programs in-house or states using other third-party vendors, HDI provides a more accurate and efficient solution for insurance verification services. A few keys to HDI’s success with insurance verification include database matching, a unique hybrid approach, ongoing verification efforts and strict security protocols.

Insurance Verification Experience

HDI’s experience with statewide insurance verification programs includes Alabama, Texas, West Virginia and Mississippi. HDI’s insurance verification programs have proven effective in Texas, where HDI has served as the prime contractor for the state’s Insurance Verification System since its inception. The Texas program is the nation’s largest, vendor run insurance verification program. The system processes 67 million queries annually and effectively integrates data from approximately 570 unique entities. With a state population of 29 million and more than 20 million registered vehicles, the system sustains the processing of more than 2.3 billion data elements weekly.

Database Matching Using Fuzzy Matching Logic

When working with large batches of data, there are bound to be discrepancies when it comes to matching records. This is where a sophisticated, customized system can make a vast difference in efficiency and accuracy, especially when insurance verification is the focus.

HDI’s systems utilize database matching within the insurance verification process. These systems efficiently pair insurance company records with registration records to verify an individual’s insurance coverage or lack thereof. The process begins with exact VIN matching and then strives to find high confidence matches through the process of fuzzy matching logic.

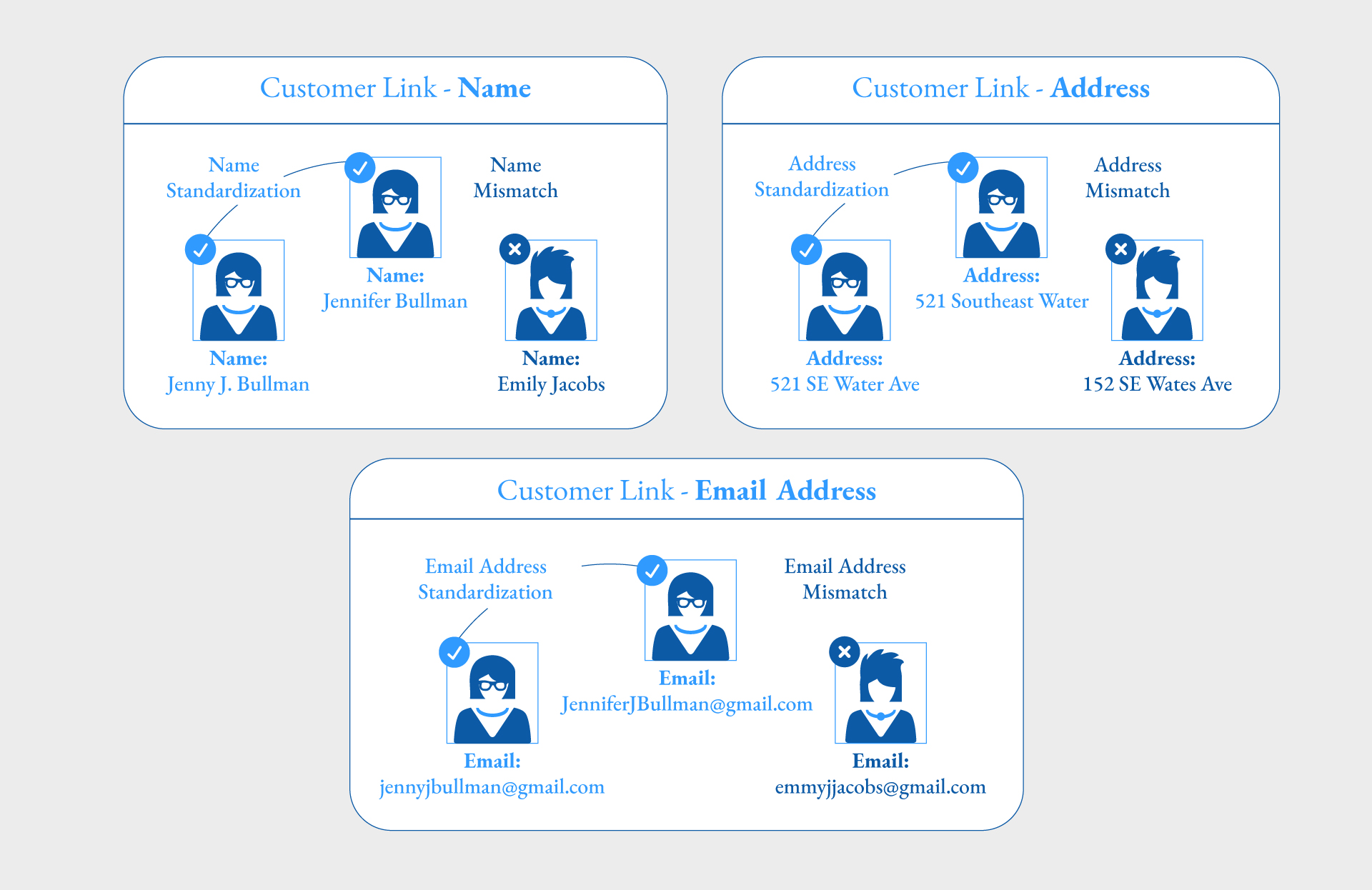

Fuzzy matching logic identifies commonly replaced letters, numbers or symbols (i.e. 1 or I, 0 or O) and common words or names that may have variants (i.e. Sarah or Sara, Jon or Jonathan, Avenue or Ave). This method of matching is sophisticated and allows for recognition of individual records that have a high likelihood of being a match based on the number of fields being reviewed and the matching algorithms implemented within the system.

While competitors may only engage in exact matching and often turn to broadcast queries when an exact match of a VIN is not found, HDI’s fuzzy matching looks beyond exact VIN matches and uses innovative logic to recognize matches in other high confidence fields. This allows HDI to conduct the majority of its queries through directed queries rather than being overly reliant on broadcast queries.

IICMVA Web Services Model

HDI’s insurance verification services are also extended to state programs following the IICMVA (Insurance Industry Committee on Motor Vehicle Administration) model. These systems are built to gather motorists’ data directly from state motor vehicle registration data and insurance companies in order to collect the most current information on file. Through web service queries to insurers, states can efficiently confirm policies through both direct and broadcast queries.

While directed queries, conducted if the insurance carrier for a specific vehicle can be determined prior to sending out a query, is preferred, the IICMVA model can also conduct broadcast queries to every insurer authorized to write policies within in the state to confirm vehicle coverage.

Database Matching + IICMVA Model = HDI’s Hybrid Model Approach

HDI’s approach to insurance verification systems is superior due to its ability to create a hybrid between the IICMVA model and database matching model.

While IICMVA queries are still conducted, the hybrid model initially pulls information from the insurance book of business and motor vehicle registration data. The result is an increase in directed queries to providers because systems have first correctly connected individuals with the insurer of record. This increases the chance of states getting a correct response from insurance companies through a directed query and limits the number of broadcast queries conducted.

HDI’s hybrid model approach has proven to be extremely effective with greater than 99% accuracy on matching.

Example: Mississippi Drive System

This hybrid model has been successfully implemented in the state of Mississippi’s insurance verification program under the Drive system. The system processes more than 2 million queries annually and effectively integrates data from 159 unique entities. Supporting the state of Mississippi’s population of 3 million, the system is able to withstand processing more than more than 1.2 billion data elements weekly.

Additionally, HDI’s hybrid model provides regular data that matches individuals to insurance policies and can help states identify individuals who are forging insurance documentation or who have never reacquired coverage after previous policies have lapsed. This approach is especially useful in decreasing uninsured motorist rates as it can be utilized through both a reactive and proactive approach to insurance verification, depending on the client’s exact program needs.

HDI’s custom software solutions are designed to accommodate various data structures from different insurance companies throughout the state. While off-the-shelf systems are more rigid in their design, HDI provides flexibility and does not require states or insurance companies to alter their program to meet software requirements. This flexibility offers states a time-saving solution where previous options were ultimately impacting implementation.

Ongoing Verification Channels and Support

HDI offers an ongoing verification program, in which states receive ongoing maintenance and support throughout the entirety of the program’s operations, with the HDI team overseeing the full project. Ongoing verification program services include call center services, letter campaigns and real-time web-based insurance verification queries allowing states to take a proactive approach in locating uninsured motorists.

When HDI first launched Texas’ Insurance Verification System in 2006, some reports showed the state of Texas had uninsured motorist rates close to 20%. According to recent statistics from the Insurance Research Council, that number is down to 8.3% thanks to the database matching systems and the diligence of the state of Texas’ ongoing verification programs.

HDI’s extensive experience working with letter campaigns has been proven successful in Texas where the state averaged more than 25,000 letters per week. These campaigns have proved effective in requesting documentation of policy information via mail and providing the necessary information to direct individuals to verify their policy information over the phone with HDI’s call center services.

HDI’s insurance verification call center operations are staffed with live operators for both inbound and outbound calls to assist motorists resolving their insurance verification statuses. Interactive Voice Response (IVR) systems are also in place for individuals to call and provide updated insurance information quickly.

Agencies that work with HDI to develop custom systems, including insurance verification solutions, are supported after launch through multiple channels to ensure the system is effective in achieving desired results.

Security Protocols for Insurance Verification Systems

HDI’s insurance verification programs offer advanced security and adhere to all necessary security standards. All data received is encrypted while at rest, in transit and in use. HDI’s secure solutions protect insurer, state agency and driver information while maintaining measures to prevent security and confidentiality breaches.

The programs employ TLS (Transport Layer Security) certificates to ensure all transmissions between the insurance companies and the state remain secure. HDI’s systems operate in a dedicated channel with a single connection, lessening the number of fault points where individual users’ credentials may be compromised.

HDI Specializes in Insurance Verification Systems Custom to the Agency

HDI’s intake of raw data provides states with uninsured motorist statistics and helps state agencies make informed decisions about how to reduce the number of uninsured motorists. Using the most technologically advanced systems in the nation to combat the problem of uninsured motorists, HDI provides a complete, customizable solution for state agency programs that is proven to be both accurate and efficient.